Wednesday, March 23, 2011

Sunday, March 13, 2011

10 Reasons:Why Indian Real Estate needs Specialist

Exclusive White Paper from realism.IN

Is real estate an independent discipline or a subset of finance, marketing, construction or management? Is real estate a science, applied science or engineering? Why should Indians specialize in real estate? realism.IN team brings a global perspective to this debate in this exclusive white paper. A must read for real estate professionals, educators, policy makers, and aspirants.

10 Reasons:Why Indian Real Estate needs Specialists (Download with registration)

Is India Ready for REITs?

Exclusive White Paper from realism.IN

In spite of being a hot emerging market India has been unable to make Real Estate Investment Trust (REIT) a reality in domestic markets. What is a REIT? Why should Indian real estate be interested, if at all? How ready are we to launch this structure for real estate investment in India? Read this realism.IN white paper for answers. Also published on India China America Institute's ChindiaBiz Series.

Is India Ready for REITS (Download with registration)

5 Steps to Building an "Information-Edge" in Real Estate

Exclusive White Paper from realism.IN

Exclusive White Paper from realism.IN

Published by the Confederation of Real Estate Developers Association of India (CREDAI) and authored by realism.IN, this article provides pragmatic insights on how to get the best out of data in real estate business. Why is data collection important? How could you develop in-house capabiliities to collect and process data? How can you maximize your profits in real estate business with such data?

5 Steps to Building an "Information-Edge" in Real Estate (Download with registration)

Labels:

CREDAI magazine,

data,

India,

real estate,

real estate education,

regression,

research

Tuesday, March 8, 2011

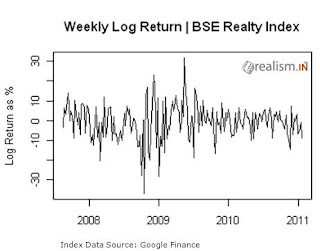

BSE Realty Index

With the First issue of realism Round-Up, we at realism.IN announce our commitment to keep you updated about Indian real estate markets: both at the Dalal Street and the Main Street. This series should provide you with fairly useful business/investment insights about the publicly traded real estate stocks in India.

What else? We also help you assess the implied volatility in the BSE Realty Index on a weekly basis. Did you know that this implied volatility is not observable; but is known to be an important factor in investment decision making? And yes, for numerous stock indices, this volatility tells a lot about future returns. So, here we go: Our analysts provide you with the implied volatility patterns extracted from their sophisticated econometric models to help you assess the risk in this index.

What else? We also help you assess the implied volatility in the BSE Realty Index on a weekly basis. Did you know that this implied volatility is not observable; but is known to be an important factor in investment decision making? And yes, for numerous stock indices, this volatility tells a lot about future returns. So, here we go: Our analysts provide you with the implied volatility patterns extracted from their sophisticated econometric models to help you assess the risk in this index.

Stay tuned for our upcoming issues which will also help you with some benchmark indices for comparison!

(click on the images below to get higher-quality illustrations)

Real Estate Development Indices

Click on the image to see a higher-quality illustration.

In July 2007, the National Housing Bank (NHB) launched the first-of-its kind residential real estate index in India named as "Residex". The Residex is based on actual transaction price of real estate in the cities covered under the index. The aggregated Residex started with 5 cities: Delhi, Mumbai, Kolkata, Bangalore and Bhopal. Later, Ahmedabad, Faridabad, Chennai, Kochi, Hyderabad, Jaipur, Patna, Lucknow, Pune and Surat were added.

Building Construction Cost Index

Click on the image to see a higher-quality illustration.

The Construction Industry Development Council (CIDC) in India has been releasing its construction cost index (CCI) since 1998. The Index measures an overall variations in the cost of construction of projects including buildings, roads, bridges, railway construction, dams, power plants, factories etc.

How to interpret the graphs: In the bar chart above, realism.IN presents you city level data sourced from the NHB and CIDC. For each city, 2007 has been assumed to be the base year rated at 100 index value. Thus, the height of the bar corresponding to a city represents the multiple by which the overall transaction prices (Residex) or the construction Cost (CCI) of the residential buildings have increased in the 2010 Q2 compared to 2007. For example, a value of 110 for New Delhi suggest that the transaction prices multiplied by 10% (i.e.110/100 minus 100 percent) with respect to 2007 prices. Similarly, a CCI of 115.25 in Chennai would imoly that the construction costs in Chennai had multipled 1.15 times since 2007 during 2010.

Subscribe to:

Posts (Atom)